Debt Elimination

Learn to refer to Debt2Capital™ and Mortgage Free Life. Train to become a Debt2Capital™ specialist.

Debt Elimination

Learn to refer to Debt2Capital™ and Mortgage Free Life. Train to become a Debt2Capital™ specialist.

Introduction

Debt2Capital™ is a unique approach to debt elimination, using the power of interest compounding to optimize the "debt snowball" process.

Typical results see consumers, who are committed to getting out of debt, and who are already paying extra $$ every month on their debts, eliminating all their debts – mortgages, credit cards, car loans, student loans, etc. – in about 1/3 the time

Introduction

Debt2Capital™ is a unique approach to debt elimination, using the power of interest compounding to optimize the "debt snowball" process.

Typical results see consumers, who are committed to getting out of debt, and who are already paying extra $$ every month on their debts, eliminating all their debts – mortgages, credit cards, car loans, student loans, etc. – in about 1/3 the time

1. The Presentation, Step 1

This video demonstrates how to deliver the initial debt elimination presentation using the software portal, focusing on client engagement and presenting the problem of debt costs. It compares traditional debt snowball methods with the proprietary D2C program.

- Log into the portal, use client demonstration mode for practice.

- Add a client and select the appropriate scenario (debt or cash accumulation).

- Presentation is built into the portal for easy access.

- Start with rapport-building and open-ended questions about the client’s debt and goals.

- Use impactful quotes (e.g., Henry Ford, CFP Board poll) to highlight the importance of debt elimination.

- Focus on agitating the problem: emphasize how much debt is costing the client, rather than selling the solution.

- Illustrate how taxes and interest are permanent losses that prevent wealth-building.

- Use real-life statements to show the high portion of payments lost to interest, especially early in loans.

- Explain how traditional minimum payments keep clients in debt for decades.

- Review traditional debt snowball: pay minimums on all debts, add extra to smallest balance, snowball payments as debts are paid off.

- Traditional method works but leaves clients with no cash reserves and risk of falling back into debt.

- Proprietary approach: extra payments go into a special whole life insurance account, building compounding interest and providing liquidity.

- The program uses monthly soft credit pulls to keep debt info accurate and automate payoff steps.

- When enough cash accumulates, clients are notified to pay off debts using policy loans, then repay themselves, keeping cash growing.

- Same monthly budget, but more efficient use of funds.

- Clients finish debt-free with cash reserves, reducing risk of going back into debt.

- Example: Clients pay off $327,000 in debt in just over six years (vs. 17.5 years with minimums), save ~$50,000 in interest, and finish with $227,000 in cash.

- Know the presentation inside and out for credibility.

- Focus on interactive, client-driven conversations.

- Encourage agents to become clients themselves for authenticity.

2. The Software, Steps 2-5

This video covers Steps 2-5 of the client onboarding process in the D2C software, with focus on data entry, credit report authorization, debt review, and client's budget creation.

Complete all required fields: name, email, address, phone number, date of birth, gender, and tobacco use. Click "Continue" to proceed.

Inform clients that the credit pull is a soft inquiry (does not affect their score) and advisors do not see the full report.

Collect necessary information including social security number.

Send a one-time text message for clients to review and accept terms and conditions.

After client authorization, send a second text for identity verification.

Complete verification to retrieve debts associated with the client.

Only pull a spouse’s credit if they have separate debts.

Review all imported debts for accuracy.

Ask clients to provide balances, minimum payments, and interest rates for each debt.

Manually add any missing debts (e.g., student loans) as needed.

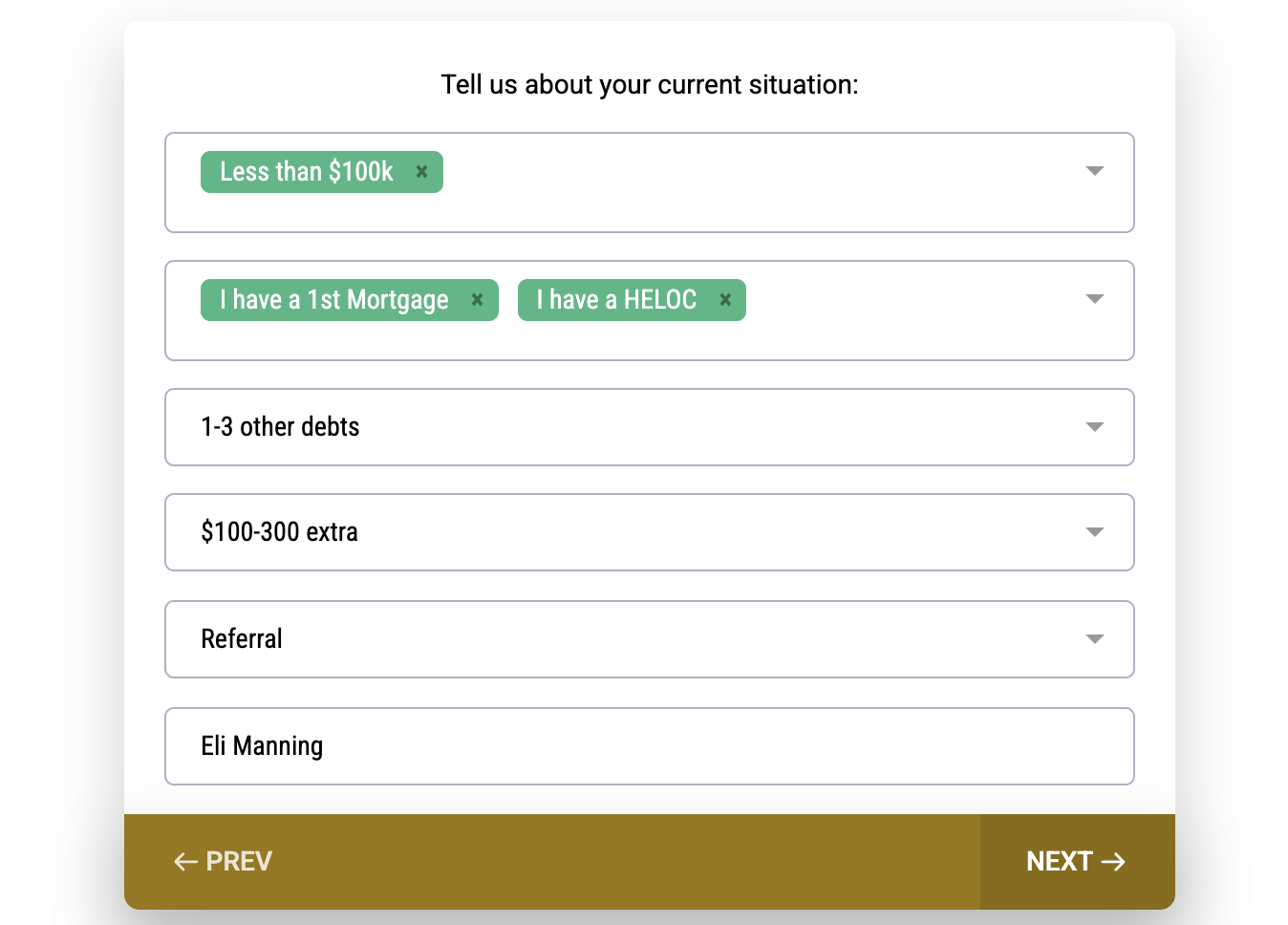

Discuss with clients how much extra they pay toward debts and any retirement plan contributions.

Advise redirecting unmatched retirement contributions or excess savings toward debt payoff.

Establish if additional funds can be allocated to the program without impacting lifestyle.

The goal is to find a workable monthly budget for the client’s debt elimination plan.

3. The Software, Steps 6-7

This video covers Steps 6 & 7 in the D2C software: generating, reviewing, and presenting the client report; with focus on understanding visuals, interpreting key numbers, and communicating results to clients.

- Detailed breakdowns provided for each debt.

- Uses color-coded graphs: green (good/principal), red (bad/interest).

- The report visually displays principal vs. interest payments and overall debt breakdown.

- Recap of previous steps;

- Shows total cost if only minimum payments are made vs. using the Debt 2 Capital™ program.

- Example: Minimum payments = $519,000 total; Debt 2 Capital™ = $400,000 total; $119,000+ saved in interest.

- Clients finish debt payoff up to 20 years faster with the program.

Graphs show when debt will be eliminated and cash value growth after payoff.

Comparison: Debt-free date with minimum payments vs. program; highlights long-term cash available after debt is gone.

- Report lists each debt, payoff date, interest savings, and time saved.

- Example: A mortgage could be paid off 21 years early, saving over $115,000 in interest.

- Adjust monthly payment scenarios ($500, $750, $1,000) for client comfort and flexibility.

- Save and send reports as PDFs labeled with client details and payment amount.

- Emphasize choosing a sustainable monthly amount, not the maximum possible.

- The goal is a comfortable, stress-free plan that fits the client’s life.

- Highlight flexibility: clients can access up to 80% of their funds in emergencies.

- The program recalculates if life changes occur, keeping clients on track.

4. The E-Application

Policy Delivery Signature

This video shows processes of completing and submitting the e-application for the Debt2Capital™ policy, covering data entry, policy design, required questions, and client signature.

- Click "Continue" after reviewing the client report.

- No need to log into the carrier portal; client data auto-populates from previous steps.

- Select "Buy Paid Up Additions" for dividend selection.

- Premium is split 50/50 between base policy and paid up additions rider (e.g., $750/mo = $375 each).

- Option to add waiver premium rider for coverage during medical hardship.

- Adjust premium if needed before proceeding.

- Verify and complete personal info: contact details, address, citizenship, social security number.

- Answer health, lifestyle, and occupation questions (detailed, but mostly straightforward).

- Review and edit answers as needed before submitting.

- Review face amount, premium split, and total risk (must be under $500,000 for instant approval).

- Add beneficiaries and banking info for premium payments.

- Optionally add spouse or backup contact for policy notices.

- Select a charity for a one-time $50 donation from GBU.

- Complete e-signature via remote sign on client’s phone.

- Submit application and receive instant approval for most cases (if under risk threshold).

- Take your time, double-check all entries, and ensure client comfort with the process.

- Educate clients on the true cost of debt, not just the product features.

- Keep the experience interactive and focused on solving the client’s problem.

Mike Hall completes a Debt2Capital™ presentation and application with an agent referral client.

Live Appointment

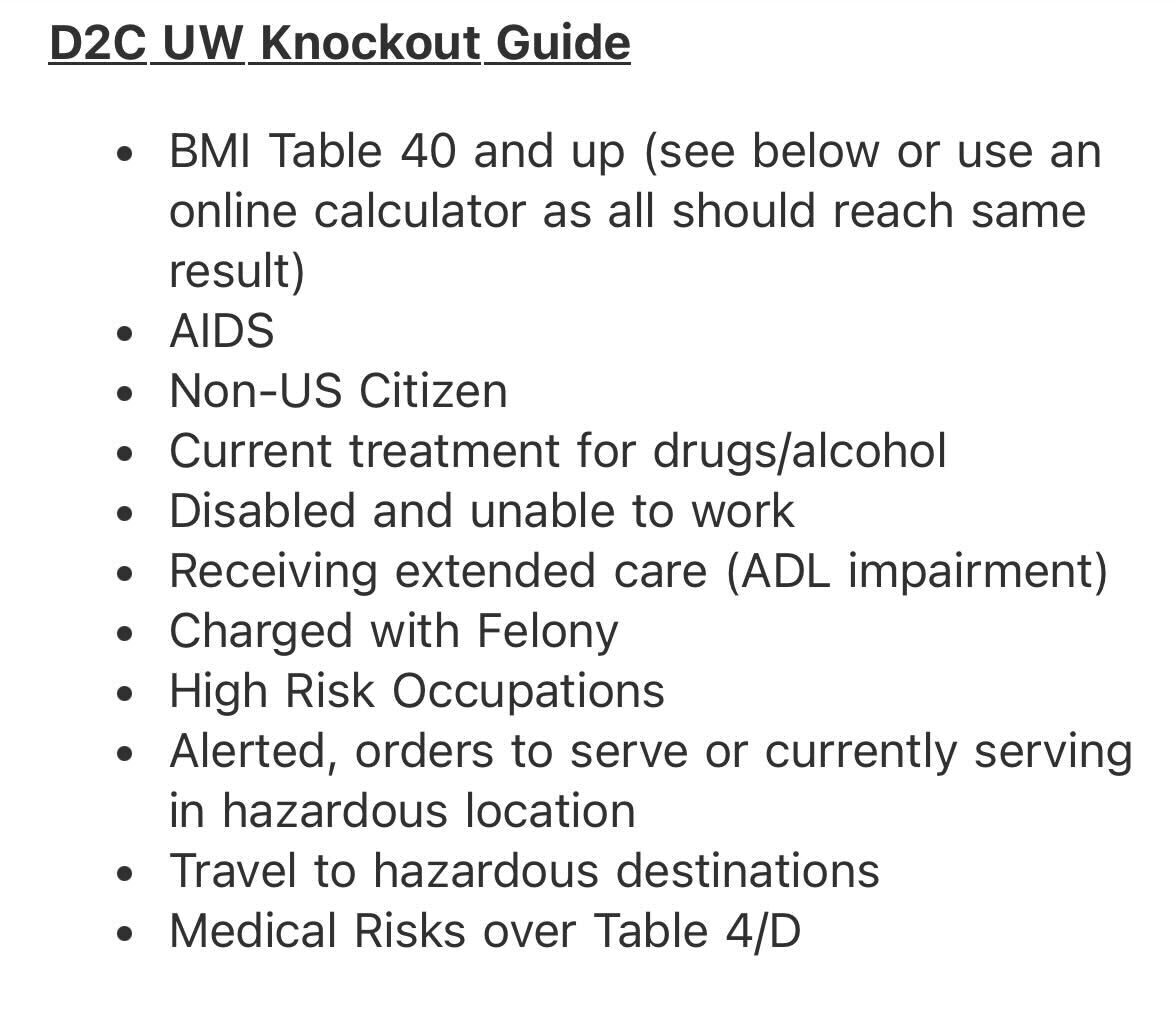

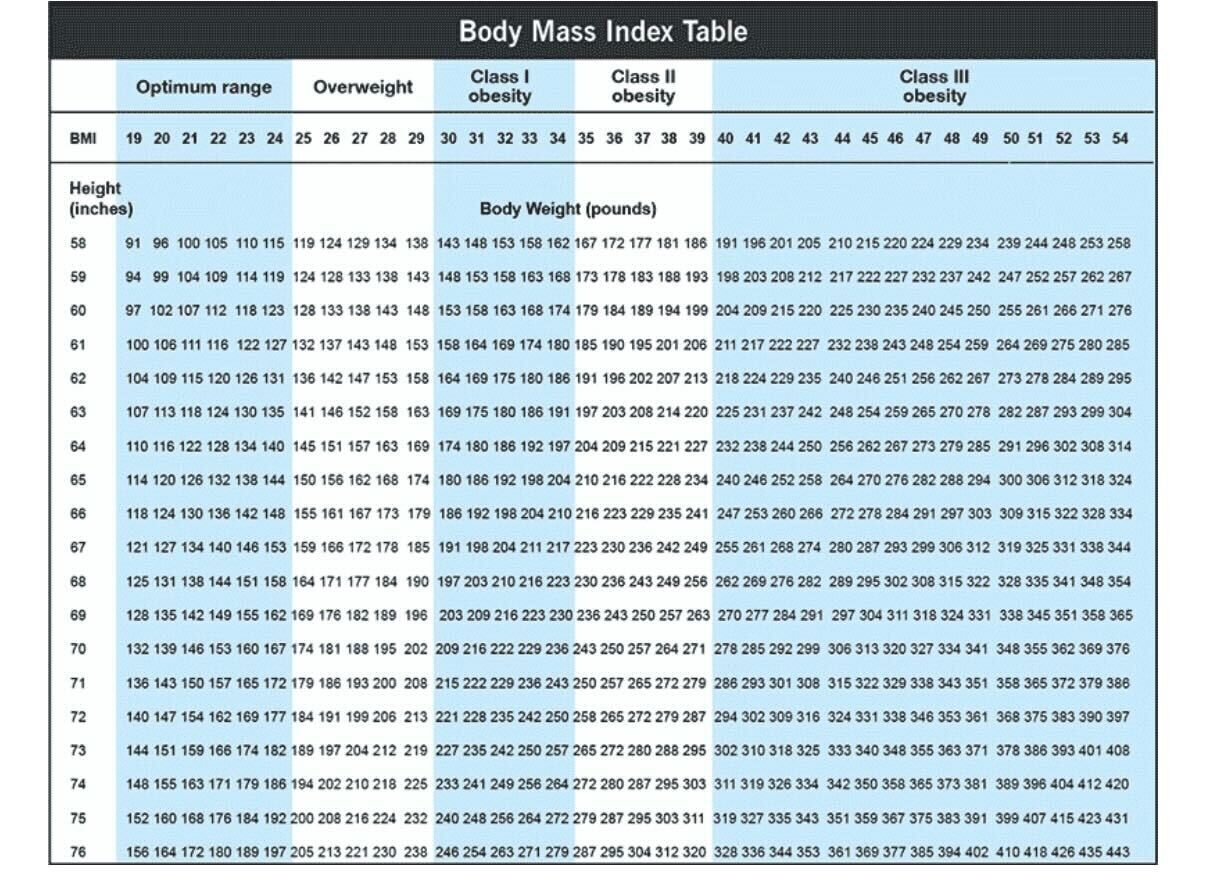

Underwriting for D2C